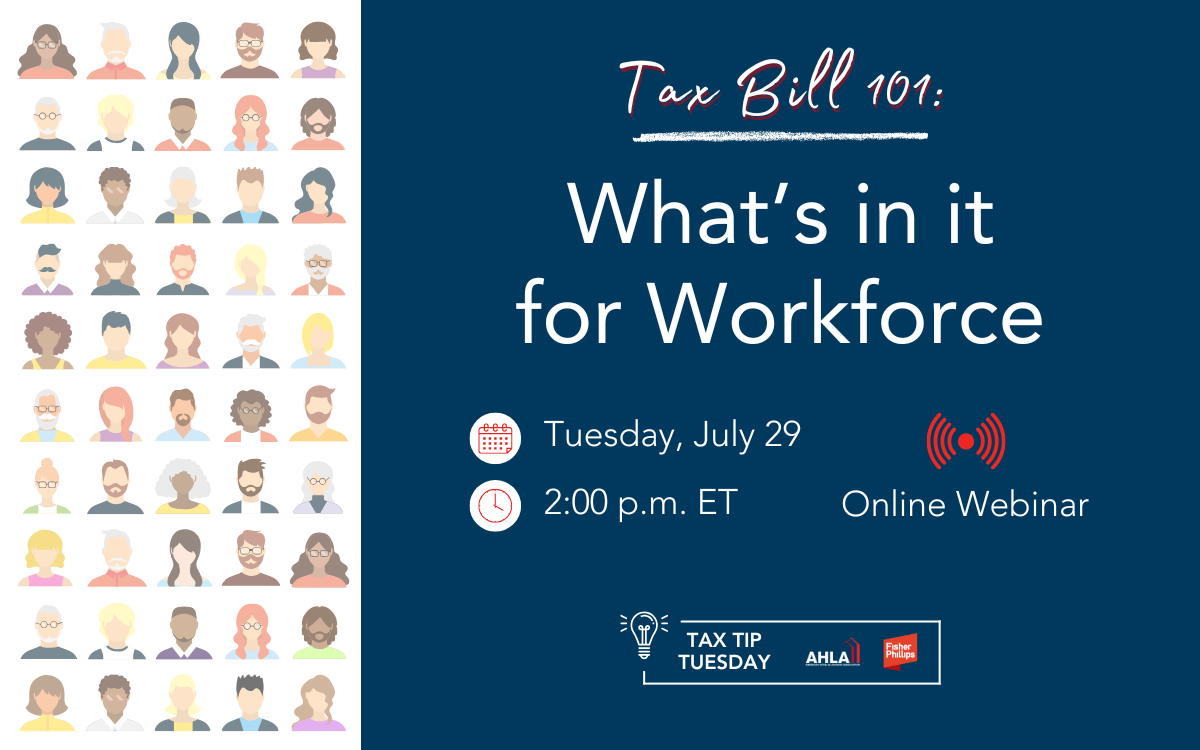

Tax Bill 101: What's in it for Workforce

The landmark tax reform package just signed into law includes many beneficial provisions for the hotel industry’s workforce.

Join AHLA and AHLA Allied member Fisher Phillips for a member-only webinar offering practical advice on new employee-centric tax provisions. The webinar will also cover additional policies that can enhance and support employee benefits. Specifically, we will focus on “No Tax on Tips,” extensions to the Child and Dependent Care Tax Credit, and the Family and Medical Leave Tax Credit.

What We'll Cover:

- How employers can begin preparing for the next tax season

- How to implement new employee-centric tax provisions

- How changes to tax law will affect you, your employees, and your business

If you have problems registering for or entering the webinar, please contact AHLA’s membership team at membership@ahla.com